LIBOR

You may be aware of the Financial Conduct Authority’s (the FCA) announcements that LIBOR would cease to be published in its then form from the end of 2021.

LIBOR stands for London Interbank Offered Rate and is a reference rate set independently of us by ICE Benchmark Administration Limited. You can find out more information about LIBOR at www.theice.com/iba/libor.

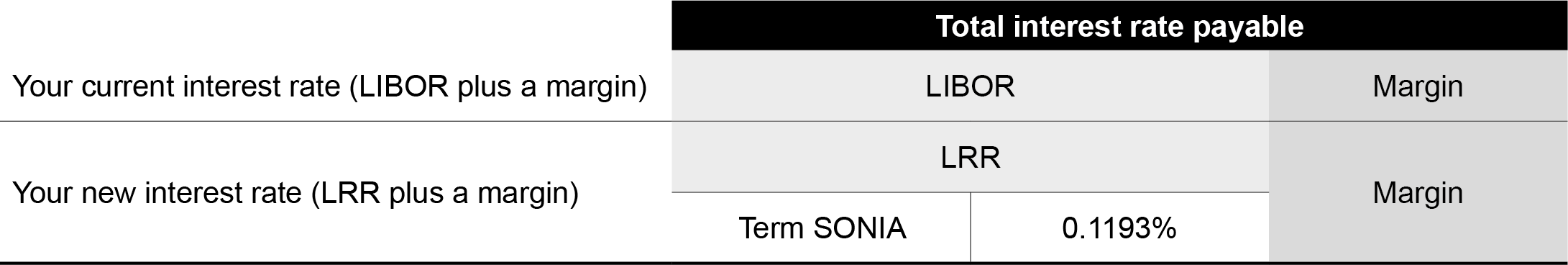

As a result of the changes to LIBOR we've replaced this as the basis for calculating the interest rate with a new reference rate if the interest rate you pay on your mortgage, or pay at the end of any fixed rate period, was linked to LIBOR.

Frequently asked questions

These frequently asked questions have been prepared to support you during the transition away from LIBOR as a reference rate. We may update these during the transition period and will publish any updates here.

The information below seeks to provide general guidance, the contents are not specific to your individual circumstances.

Further information is available from the Financial Conduct Authority and UK Finance websites.

If you have any questions please contact us and we’ll be happy to help.

-

1. What is LIBOR?

-

2. Why is LIBOR being phased out?

-

3. Why have you chosen 3-Month Term SONIA plus 0.1193% as the LIBOR Replacement Rate (LRR)?

-

4. What is Term SONIA?

-

5. Why are you adding an adjustment to Term SONIA?

-

6. How has the adjustment been calculated?

-

7. How will the interest rate on my mortgage be calculated following the switch to LRR?

-

8. What are my options if I don’t want to move onto the new rate?

-

9. As LIBOR is continuing to be published on a revised basis after the end of 2021 why have you made this change now?

-

10. How does this change impact my mortgage?

-

11. Am I going to pay the same amount?

-

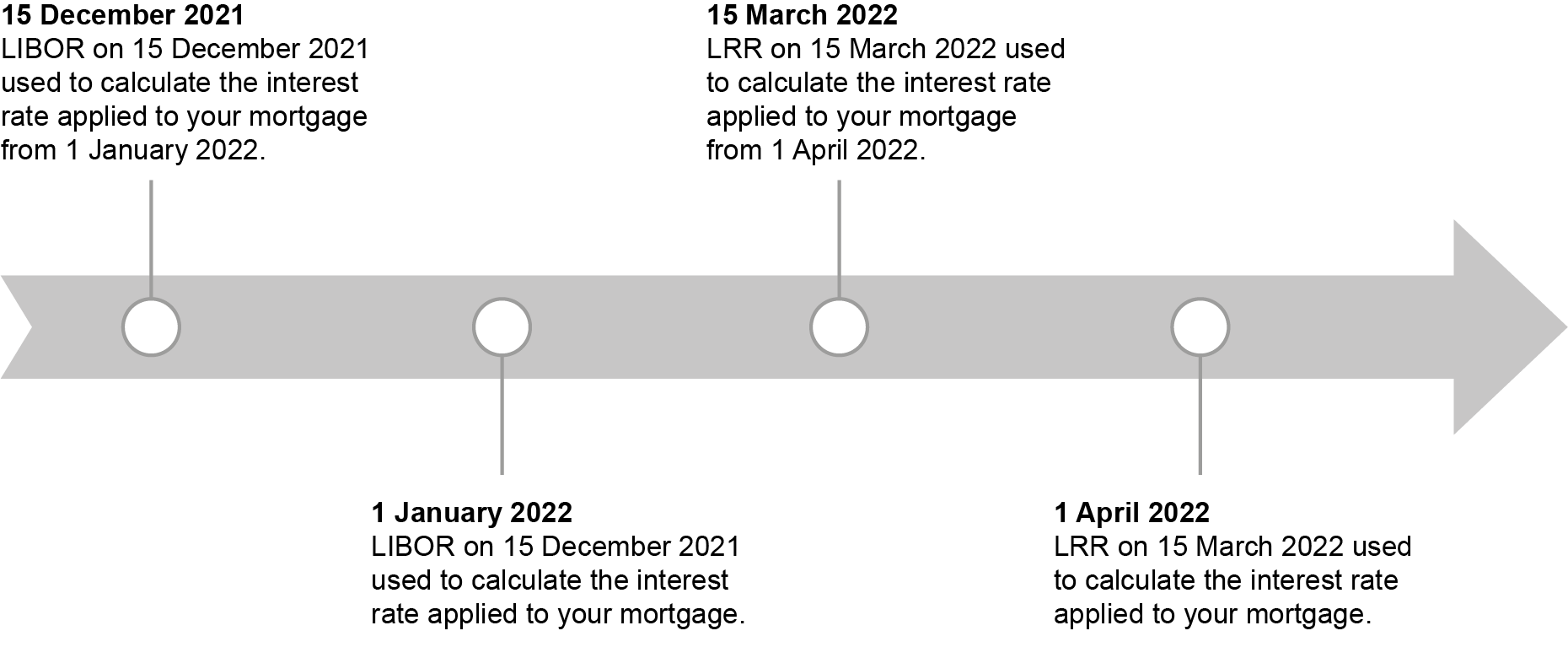

12. When will the change to the replacement rate take effect?

-

13. Will any of my statements and letters change?

-

14. Where can I go for further information?